On the highways that crisscross our nation, commercial trucks are a common sight, playing a crucial role in our economy. With their considerable size, often weighing up to 80,000 pounds, it’s no surprise that truck drivers and trucking companies are required by law to carry insurance meant to cover the high costs of property damage and medical bills in the event of a crash.

This requirement seems logical, given a truck crash’s potential for catastrophic outcomes. However, the reality of commercial vehicle insurance is more complicated.

Since the trucking industry was deregulated in 1980, the Federal Motor Carrier Safety Administration (FMCSA) set mandatory insurance minimums of $750,000 for commercial trucks. These minimums were intended to protect truck crash victims, ensuring they receive adequate compensation. But this minimum insurance requirement has not been updated since it was established –nearly 45 years ago – making this $750,000 in coverage woefully inadequate in today’s economy.

As a result, victims of truck accidents often find themselves navigating a labyrinth of legal and financial challenges, struggling to secure the compensation needed to cover their extensive losses and leaving taxpayers to pick up the bill. By delving into the real-world consequences of these policies and the complex journey toward just compensation, we aim to bring to the forefront the critical issues at play, arming individuals with the knowledge to confront the challenges brought about by large truck insurance minimums head-on.

What are Insurance Minimums?

Insurance minimums are the lowest level of insurance coverage that truck drivers and commercial trucking companies are legally required to maintain. This requirement ensures that in the event of a crash, there are guaranteed funds available to cover property damage, medical bills, and other resulting expenses.

For the majority of motor carriers, this minimum coverage amount is $750,000. However, the Federal Motor Carrier Safety Administration (FMCSA) has set more specific commercial truck insurance requirements based on the cargo the truck is carrying.

Additional Guidance on Insurance Minimums Is Broken Down as Follows:

- $300,000 for trucks under 10,001 pounds not carrying hazardous materialsAny item or agent (biological, chemical, physical) that has the potential to cause harm to humans, animals, or the environment, either by itself or through interaction with other factors. Can be referred to as HAZMAT..

- $750,000 for trucks over 10,001 pounds not carrying hazardous materials.

- $1 million for private drivers hauling oil.

- $5 million for drivers carrying hazardous materials other than oil.

These minimums are set at the federal level, but there may be additional state requirements that increase the commercial trucking insurance requirements.

If a trucking company cannot afford the costs associated with being on the road safely, the public cannot afford the risk of that trucking company on the road.

Insurance minimums are designed to act as a safety net, protecting not only the parties involved in an accident but also the public from the financial repercussions of such incidents. As a critical component of the trucking industry's regulatory framework, they aim to facilitate fair compensation and support recovery for those affected.

Referrals & Co-Counsel

Involved in a Crash?

No other law firm knows trucks quite like us. Our trucking law expertise and trial experience allow us to win multi-million-dollar results year after year.

Our team of truck accident attorneys works tirelessly to help your family find justice in the wake of a catastrophic truck crash.

Referrals & Co-Counsel

No other law firm knows trucks quite like us. Our trucking law expertise and trial experience allow us to win multi-million-dollar results year after year.

Involved in a Crash?

Our team of truck accident attorneys works tirelessly to help your family find justice in the wake of a catastrophic truck crash.

When Were Modern-Day Insurance Minimums Set?

The current federal insurance minimums for commercial trucks were established as part of the Motor Carrier Act of 1980. This bill aimed to increase competition within the industry and reduce transportation costs, but many of these initiatives came at the cost of long-term safety.

Since 1980, insurance minimums have remained largely unchanged. The ongoing debate over the adequacy of these minimums highlights the balance between operational costs for trucking companies and the need for sufficient compensation for accident victims.

Who Is Responsible for Setting Motor Carrier

Insurance Minimums?

The Federal Motor Carrier Safety Administration (FMCSA)The U.S. federal agency that regulates the trucking industry., a division of the United States Department of Transportation, is responsible for regulating and overseeing these requirements. While there have been discussions and proposals to increase these minimums to account for inflation and the rising costs of medical care, no significant adjustments have been made since Ronald Regan was President.

In addition to federal requirements, individual states may impose their own insurance requirements for commercial trucks operating within their borders. These state-level requirements can vary significantly and may exceed the federal minimums, especially in states with higher costs of living or unique transportation challenges. It's important for trucking companies and independent operators to be aware of these variances and ensure they meet all applicable insurance requirements.

Electing Higher Insurance Minimums

While federal and state regulations set the baseline for insurance coverage, it's important to note that trucking companies have the option to elect higher insurance minimums than those mandated. Many large motor carrier fleets and truck companies that care about safety and protecting their assets, choose to exceed the minimum insurance requirements, sometimes purchasing tens or hundreds of millions of dollars in insurance.

This additional coverage can be crucial in instances of severe accidents, where damagesIn a civil lawsuit, money designed to compensate an injured person. This includes economic damages (measurable financial loss like medical expenses) and non-economic damages (categories like pain and suffering or loss of love.) and medical expenses far exceed the federal or state minimums, providing a broader safety net for the company and affected parties.

How Is the Insurance Minimum

Amount a Safety Issue?

When insurance coverage fails to reflect the true costs of a crash, trucking companies and their drivers may not feel incentivized to invest in higher safety standards or more comprehensive insurance coverage. This dynamic can lead to a vicious cycle where the financial protections meant to ensure accountability and safety are undermined by outdated regulations.

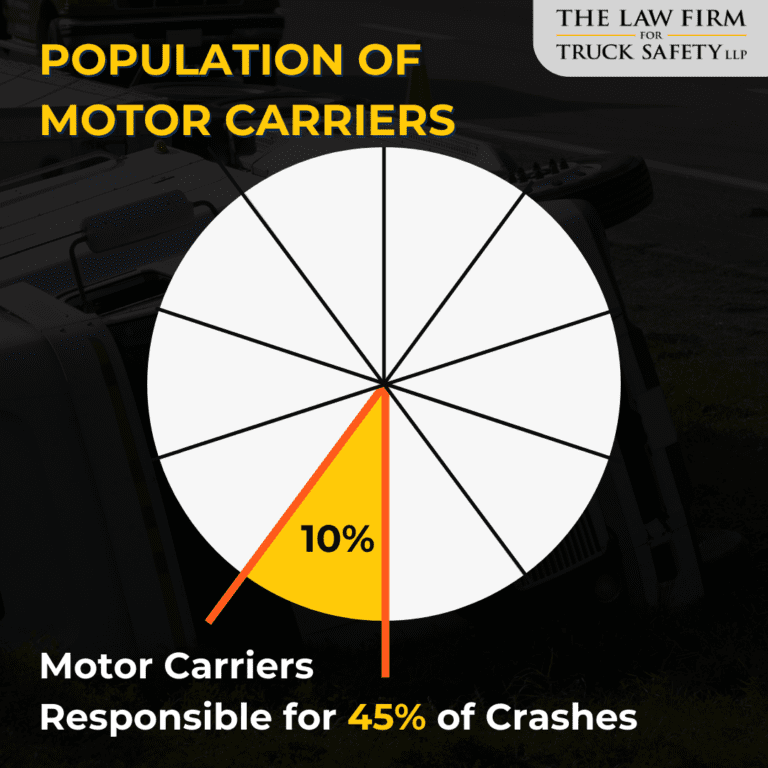

Moreover, an increased insurance minimum would disqualify unsafe operators who might neglect essential safety practices or maintenance due to budget constraints, thereby safeguarding our roads for everyone. According to the Government Accounting Office, approximately 10% of the motor carriers cause about 45% of the crashes.

The Government Accountability Office reports that roughly 10% of motor carriers are responsible for nearly half of all crashes, accounting for about 45%.

Put simply, if a motor carrier cannot afford the costs associated with being on our roads safely, public safety cannot afford the risk of their presence on the road.

Why Is $750,000 Inadequate?

Semi-trucks and other commercial vehicles pose a significantly higher risk of causing catastrophic injuries and death when they are involved in a crash. This means the financial repercussions associated with a truck crash far exceed those of typical car crashes, both in scale and complexity. Despite appearing substantial, the standard $750,000 insurance minimum frequently falls short of adequately covering the claims of even a single survivor of a truck crash, not to mention the claims of multiple victims, which is often the case in these devastating incidents.

A common misconception is the belief that the $750,000 insurance coverage functions similarly to airline insurance, where each affected individual receives coverage up to that amount. However, in reality, $750,000 is the total available for all claims stemming from a single incident. This means that in a situation where five individuals are injured or killed, this $750,000 is divided among them. This division drastically reduces the potential compensation to an average of $150,000 per person, an amount that would be inadequate to cover medical bills, lost wages, and other damages incurred from a crash.

Not only this, but the $750,000 minimum coverage was set in 1980. Adjusting for medical inflation, today’s equivalent would be nearly $5.6 million.

This gap underscores a fundamental problem with the insurance minimums: not only do they fail to align with today's economic conditions, but the method of disbursing these funds post-accident also complicates the path to adequate compensation.

Did you Know?

At The Law Firm for Truck Safety, five of our lawyers hold a Commercial Driver’s License (CDL). No other personal injuryLegal term for an injury to the body, mind, or psyche, as opposed to an injury to property. law firm in the country has as many lawyers with CDLs as The Law Firm for Truck Safety does.

Free Trucking Injury Case Review

How Can a Truck Crash Attorney Help Victims Receive the Compensation They Need?

Faced with the gap between minimal insurance coverage and the substantial costs of a truck accident, victims need strong advocacy and legal representation to secure the compensation they deserve. A truck crash attorney plays a crucial role in this process by:

- Identifying all potential compensation sources through detailed investigations.

- Negotiating forcefully with insurance companies to counter lowball offers.

- Taking cases to court when necessary, using their litigation expertise to advocate for fair settlements.

- Leveraging complex trucking regulations to bolster the victim's case.

- Comprehensively valuing all damages, including medical expenses, lost income, and non-economic losses like pain and suffering.

In essence, a truck crash attorney serves as a critical advocate for victims, working tirelessly to bridge the gap between the inadequate insurance minimums and the true costs of a truck crash. They empower victims, giving them a voice and the means to secure the financial support necessary for a full and fair recovery, despite the challenges posed by existing insurance frameworks.

The Case for Raising Insurance Minimums

The need to increase insurance minimums for semi-trucks is decades past due, not only to align with the escalating medical expenses victims face but also to reflect the greater potential for damage these larger modern trucks possess.

Since 1980, trucks have grown in size, amplifying their capacity for destruction in accidents. Higher insurance minimums would more accurately cover the resulting increased costs.

The intent behind insurance minimums is to encourage safer driving practices among trucking companies and drivers. However, the current low minimums fail to serve as a deterrent or an incentive for adopting stringent safety measures. To truly influence behavior and enhance road safety, these minimums must be significantly raised, ensuring that any uptick in premium costs due to accidents is keenly felt by the carriers themselves.

A Stagnant Insurance Minimum Harms Safe Trucking Companies and the Public

Even when truck accident victims secure settlements exceeding the mandatory insurance minimums, outcomes may still not be enough to compensate victims for all that has been taken from them. Larger trucking companies, capable of settling multi-million-dollar claims, might pay as required, but smaller companies—forming the industry's majority—might opt for bankruptcy. This maneuver allows them to sidestep responsibility and resurface as a new entity, typically opting for the bare minimum insurance coverage once more, thus maintaining a superficially clean slate.

This cycle leaves victims and their families in a precarious position, frequently forcing them to rely on public health programs like Medicare or Medicaid. This not only places an undue burden on taxpayer-funded programs but also disadvantages larger, more safety-conscious trucking companies.

Responsible and safe trucking companies face higher insurance premiums, not because of their own practices, but because the insurance industry must account for a higher risk pool that includes numerous unsafe carriers at the $750,000 minimum coverage level. Thus, premiums inflate across the board, unfairly penalizing the motor carriers who prioritize safety.

Smaller trucking companies exploiting this system contribute to a persistent cycle of risk and irresponsibility, with the financial repercussions and safety risks unfairly shifted onto the public and conscientious companies. Increasing the federal insurance minimum stands as a vital measure to break this cycle. It would ensure that all trucking companies, regardless of their size, are held financially accountable for their safety practices, promoting a fairer and safer industry landscape.

How Trucking Insurance Minimums Can Affect You

Even if you’ve never been directly involved in a truck accident, the implications of these insurance minimums ripple across society. The existence of "chameleon carriers" — companies that dissolve and reappear under new names to avoid financial liabilities — exacerbates the issue.

Unable to provide the compensation victims rightfully deserve, these carriers indirectly force many to turn to taxpayer-funded programs like Medicare and Medicaid for medical expense coverage. This practice places an additional financial burden on the public, highlighting a broader economic and social impact of the current insurance minimums.

If you or your loved one has suffered at the hands of a negligent truck driver or trucking company, it can be difficult to quantify the ways and depth of how you’ve been harmed. This is where the support of an experienced truck accident attorney comes in. With many trucking companies opting for the minimum required $750,000 insurance policies, victims often find that settlements fall short of covering their extensive medical and rehabilitative costs. This shortfall leaves victims with no option but to seek further legal action, underscoring the necessity of enlisting a competent truck accident attorney to pursue adequate compensation.

Raising awareness about the consequences of these insurance policies is vital. It not only affects victims and their families but also has a wider economic implication, stressing the importance of legal expertise and the need for systemic change in insurance regulations to ensure fair and comprehensive coverage for all affected parties.

Take the first step on your path to justice.

The Law Firm for Truck Safety’s truck accident attorneys are here to help you find answers, pursue justice, and receive the compensation you deserve.

Connect with a Law Firm for Truck Safety attorney today.

FAQs about Insurance Minimums for Trucks

What is the insurance minimum for commercial trucks?

The insurance minimum for commercial trucks depends on a variety of factors, including the type of cargo the truck is carrying. But for many trucks, federal law puts the insurance minimums at $750,000.

Who controls insurance minimums for commercial trucks?

Today's minimums were originally established in 1980 by the United States Department of Transportation.

What additional insurance coverage might trucking companies have?

Commercial vehicle drivers and trucking companies may choose to invest in a number of different kinds of commercial truck insurance. Common insurance coverage includes:

- Cargo insurance to cover the type of cargo (the minimum depends on the type and amount of goods the truck is hauling)

- Bobtail insurance to cover the driver and truck after the load is delivered and before they pick up another load

- Physical damage insurance to cover the truck for any damage that occurs

- Limited depreciation coverage as gap insurance between the fair market value of the truck and the cost to replace the vehicle if it’s totaled in an accident

- Mechanical breakdown insurance to cover any out-of-pocket costs for repairs

- Non-trucking liabilityLegal responsibility for one's acts or omissions. In negligence cases, liability includes proving negligence, proving causation, and resulting damages. insurance for accidents that occur if the truck is being used for non-business purposes

- On-hook coverage protects against damage to a truck being towed by another vehicle

These types of insurance coverage are important because a skilled attorney may be able to make the case to pull from these policies to cover damages not covered by the standard policy.

How much do truck accidents cost?

Truck accident costs can vary dramatically, influenced by the crash severity, vehicles involved, and injuries sustained. Given these variables, the financial impact of such accidents is significant.

What would the insurance minimum coverage amount be today, if it were adjusted for inflation?

The $750,000 insurance minimum set in the 1980s is now grossly inadequate when considering inflation, rising medical expenses, and other associated costs of truck accidents. An adjustment for the medical cost of inflation suggests that a more realistic minimum in 2024 would be nearly $5.6 million, reflecting the true financial implications of modern truck accidents and highlighting the pressing need for regulatory updates to better protect victims and ensure fair compensation.

Why haven’t insurance minimums for commercial trucks been updated since 1980?

Despite the clear need for adjustments due to inflation and increased costs, insurance minimums have remained static due to a combination of legislative inertia, industry resistance to increased costs, and the lengthy process required for regulatory change at the federal level.

How does underinsurance affect the general public and not just truck accident victims?

Underinsurance in the trucking industry can lead to higher costs for public health programs like Medicare, Medicaid, and Tricare when accident victims turn to these resources for care. This, in turn, places a financial burden on taxpayers and can impact public health funding and resources.

What role do insurance companies play in promoting safety within the trucking industry?

Insurance companies can incentivize safety through tiered premiums, offering lower rates to motor carriers that invest in safety training, adhere to strict maintenance schedules, and implement advanced safety technologies. These practices can lead to fewer accidents and claims, encouraging a culture of safety industry-wide.

Can victims of trucking accidents seek compensation beyond the trucking company’s insurance?

Yes, depending on the case, victims might seek compensation from multiple sources, including the truck manufacturer, cargo loaders, or even government entities responsible for road maintenance, if negligence can be proven. The Law Firm for Truck Safety is routinely successful in settling cases beyond the available insurance coverage.

How can policymakers and the trucking industry work together to improve safety and insurance standards?

Policymakers and the trucking industry can collaborate on developing more realistic insurance minimums, investing in advanced safety technologies, and enhancing driver training programs. Open dialogues and partnerships can lead to regulations that protect both the public and the viability of the trucking industry.

What steps can individuals take if they are involved in a trucking accident?

Individuals should prioritize their safety and health immediately following an accident, seek medical attention, and then consult with an NBTA board-certified truck accident attorney. Documenting the scene, gathering witnessAny person who provides testimony in a trial. This includes, but is not limited to, eyewitnesses. information, and keeping detailed records of medical treatments can also be crucial for any subsequent legal action.

Contact The Law Firm for Truck Safety

Navigating the complexities of truck accident claims in light of unjust insurance minimums demands knowledgeable legal support. The Law Firm for Truck Safety is a truck accident law firm uniquely positioned to champion the rights of those affected by serious and catastrophic truck crashes.

Our legal team boasts the highest number of National Board of Trial Advocacy-certified attorneys in the nation, underscoring our commitment to our excellence in this complex area of personal injury law. We also have more personal injury lawyers with Class A Commercial Driver’s Licenses, granting us first-hand experience into the rules, regulations, and standards that govern the trucking industry.

This deep understanding, combined with our extensive experience in trial and truck safety law, enables us to identify and leverage crucial case facts that may elude other legal teams.

Our achievements for our clients are a testament to our dedication: we have secured over half a billion dollars in settlements and verdicts, with more than 60 of our settlements and verdicts exceeding $2 million. Among these, a groundbreaking $42.4 million verdict stands out as the largest truck crash verdict in Ohio.

Discover how the truck accident attorneys at The Law Firm for Truck Safety can help you secure the full and fair compensation you deserve.

SCHEDULE YOUR FREE CASE CONSULTATION

(800) 628-4500